Payment of Accounts, Taxes, Bills. Filling and Calculating Tax Form Stock Vector - Illustration of documents, date: 153610968

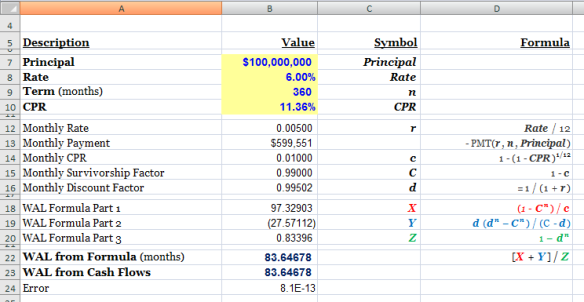

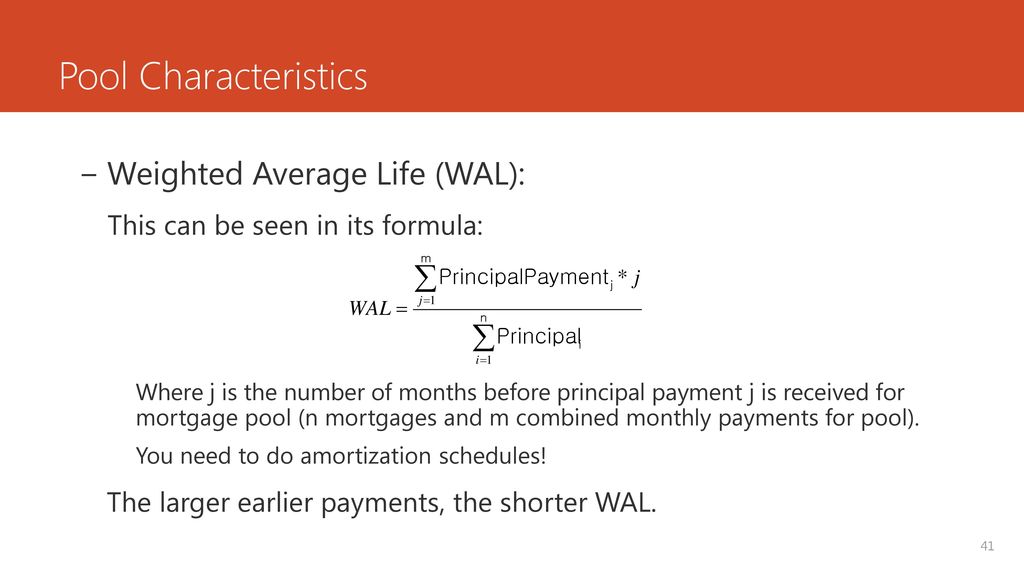

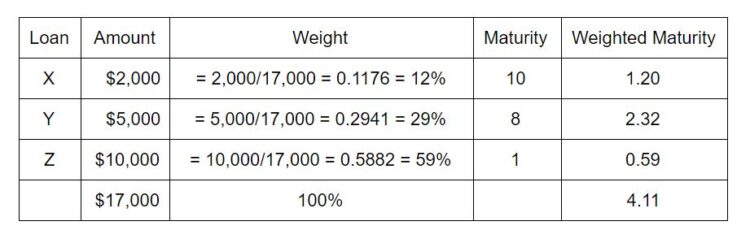

If 150 $200,000 mortgages in a $60 million 15-year mortgage pool are expected to be prepaid in three years and the remaining 150 $200,000 mortgages are to be prepaid in four years,

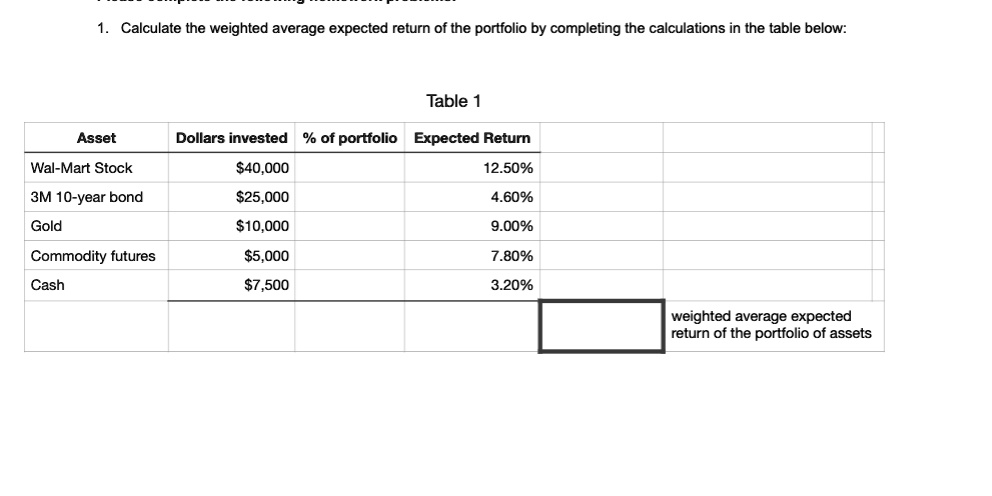

The Retail Revolution: How Wal-Mart Created a Brave New World of Business: Lichtenstein, Nelson: 9780312429683: Amazon.com: Books

WAL to carry out addition and subtraction calculations involving numbers up to 4 digits using mental strategies; to calculate in

Railway and locomotive engineering : a practical journal of railway motive power and rolling stock . WAl S( I KKT^ AI. K ^K K .ill MTKPV.MAES. l-OR IXSIliK AIIMISSION PISTON calculated

The equation of state of some gases can be expressed as Vander wal equation i.e. (P +a/v2)(V – b) = RT Where P is the pressure, V is the volume, T is

:max_bytes(150000):strip_icc()/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)