Capital Adequacy - Credit Risk Weights for Internal Ratings Based & Advanced Measurement Approaches - FinanceTrainingCourse.com

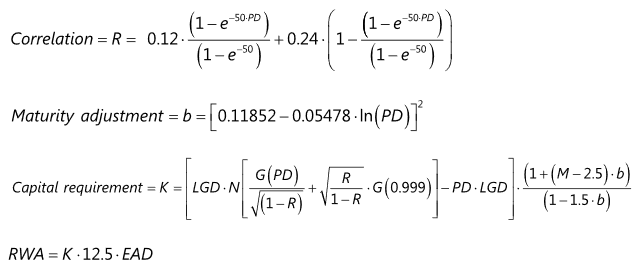

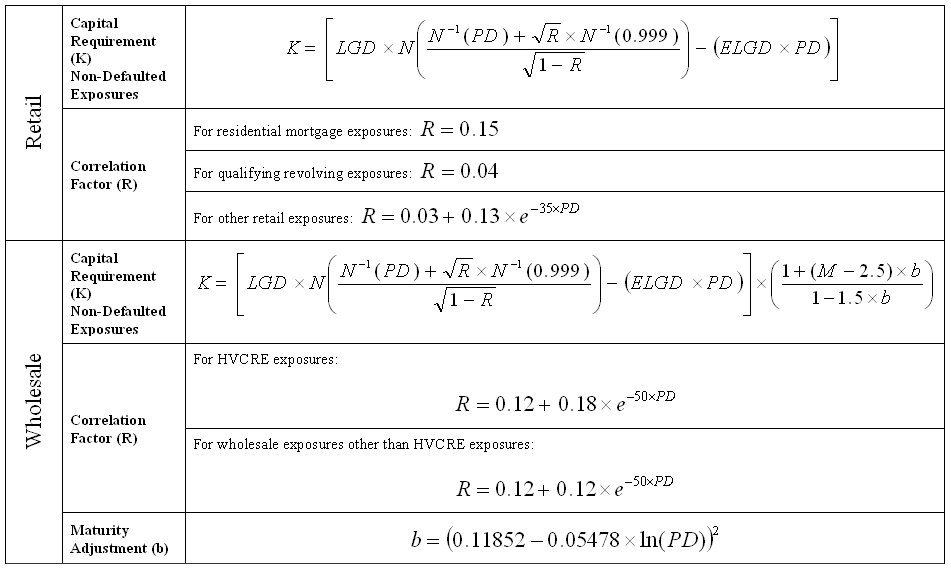

FDIC: FIL-86-2006: Proposed Rule on Risk-Based Capital Standards: Advanced Capital Adequacy Framework

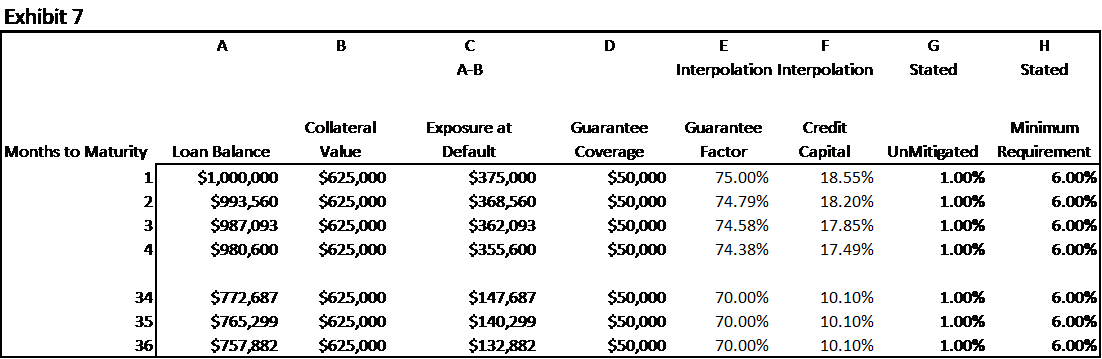

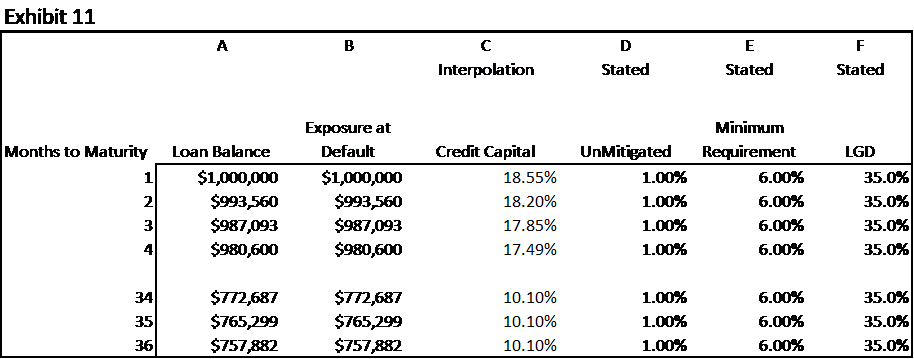

Basel II Capital Accord - Notice of proposed rulemaking (NPR) - Proposed Regulatory Text - Part IV - Risk-Weighted Assets for General Credit Risk

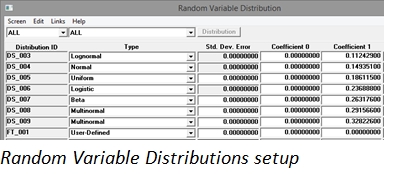

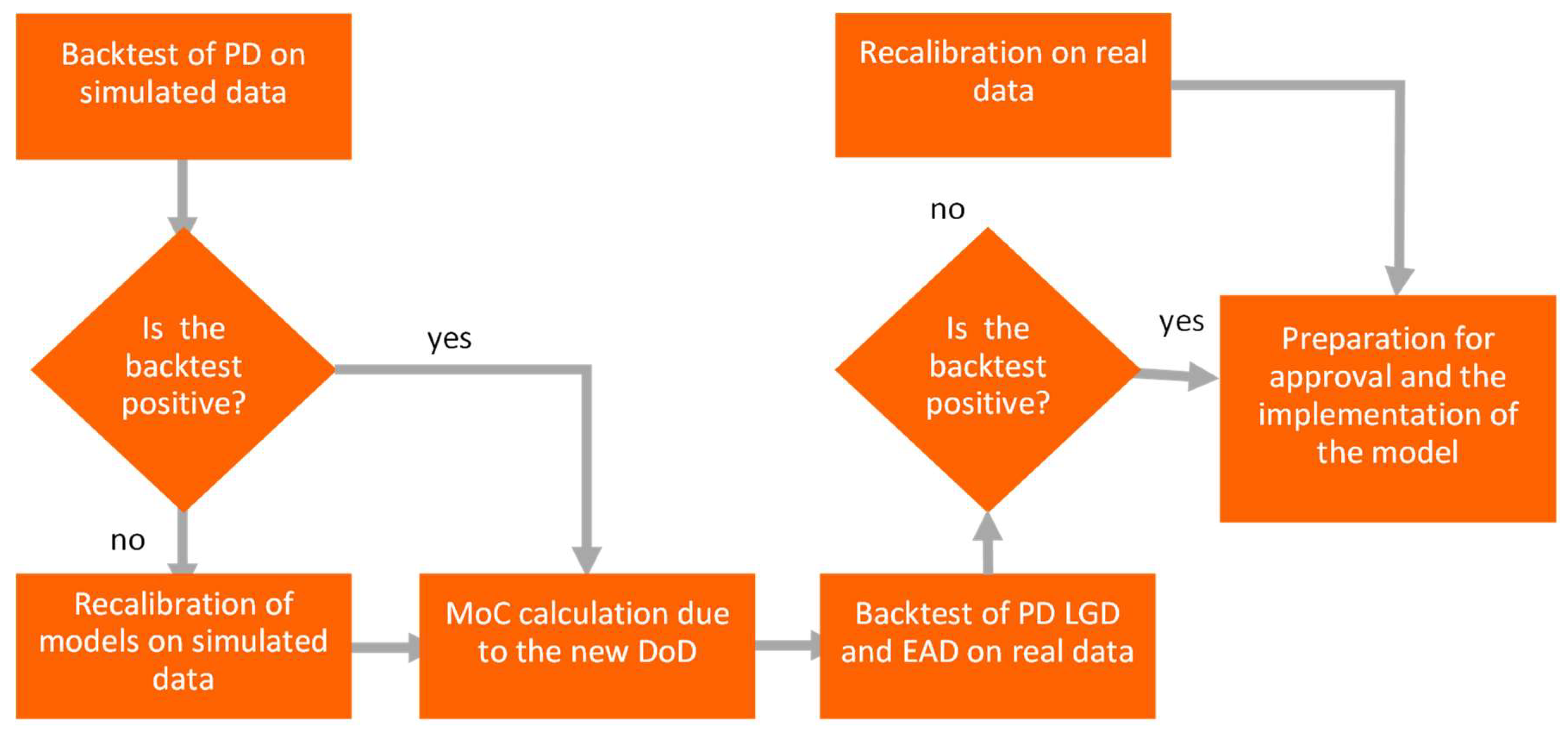

Risks | Free Full-Text | New Definition of Default—Recalibration of Credit Risk Models Using Bayesian Approach

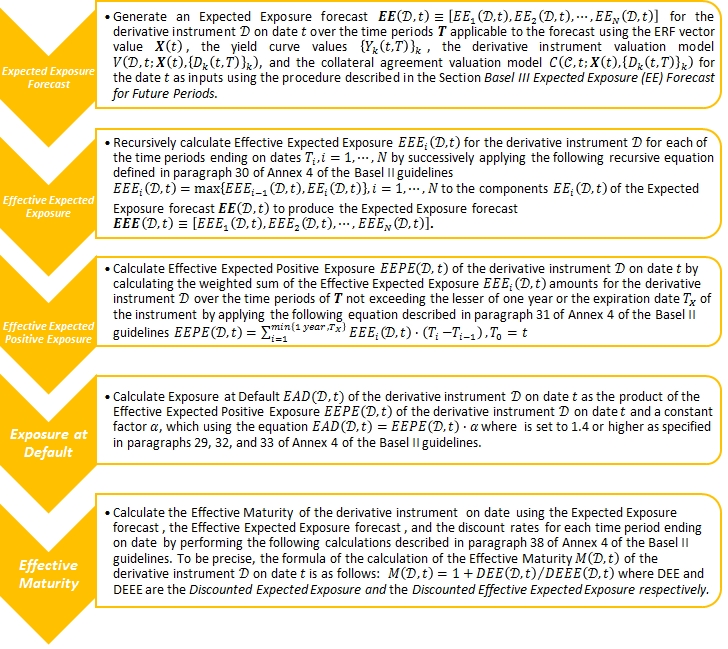

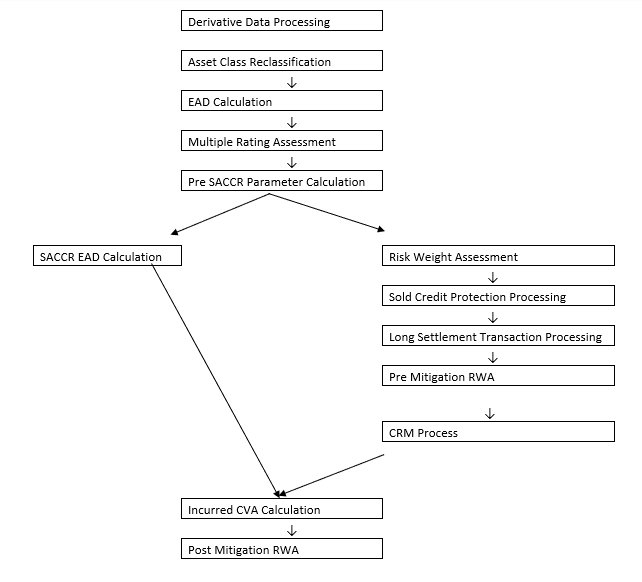

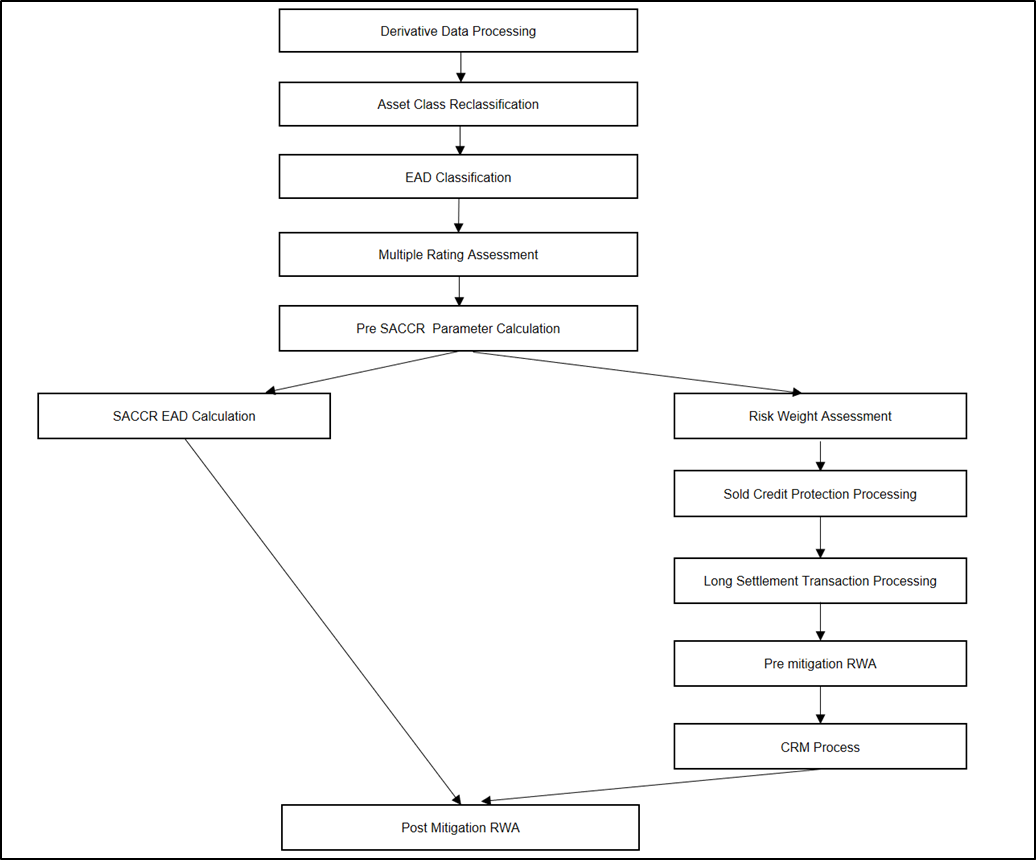

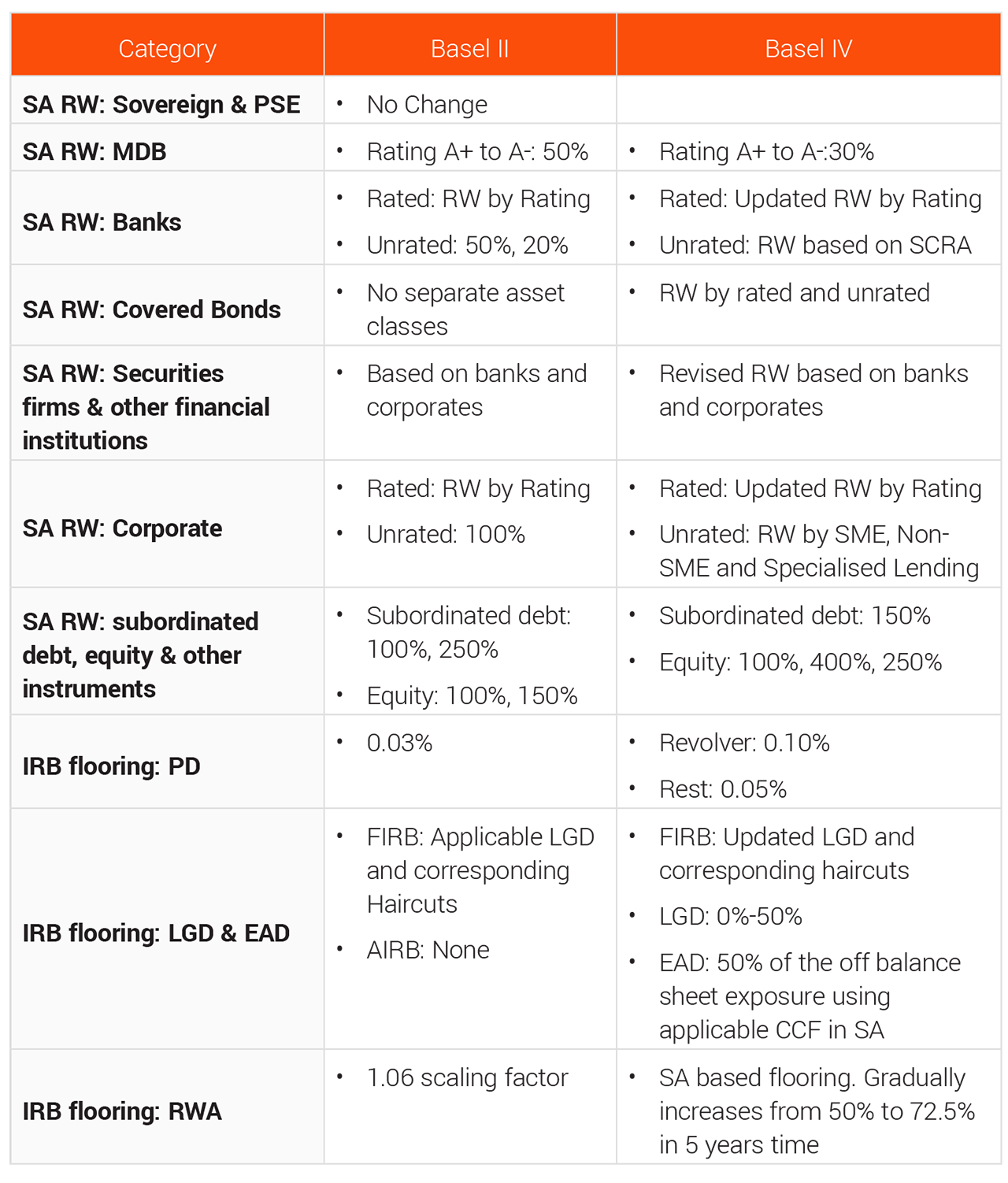

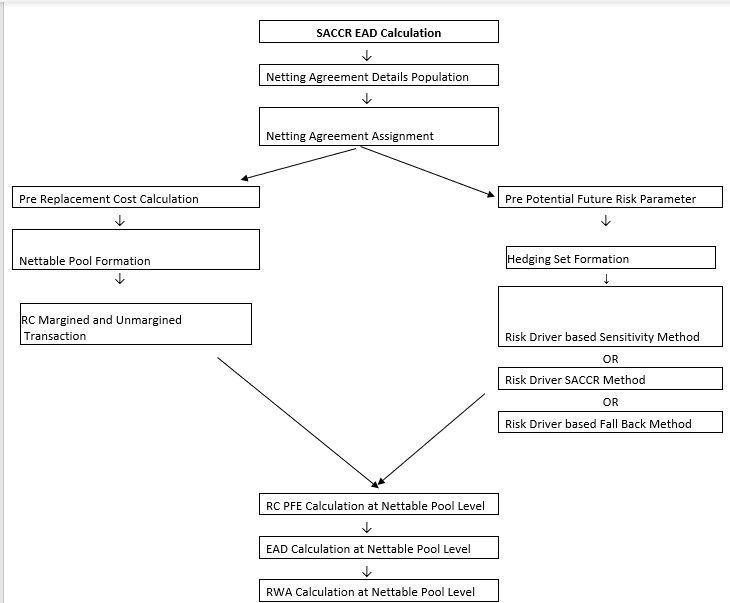

Basel IV: Calculating EAD according to the new standardizes approach for counterparty credit risk (SA-CCR)

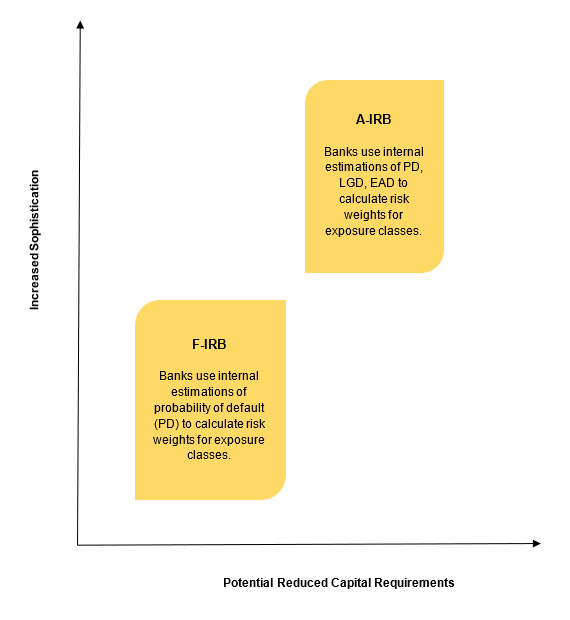

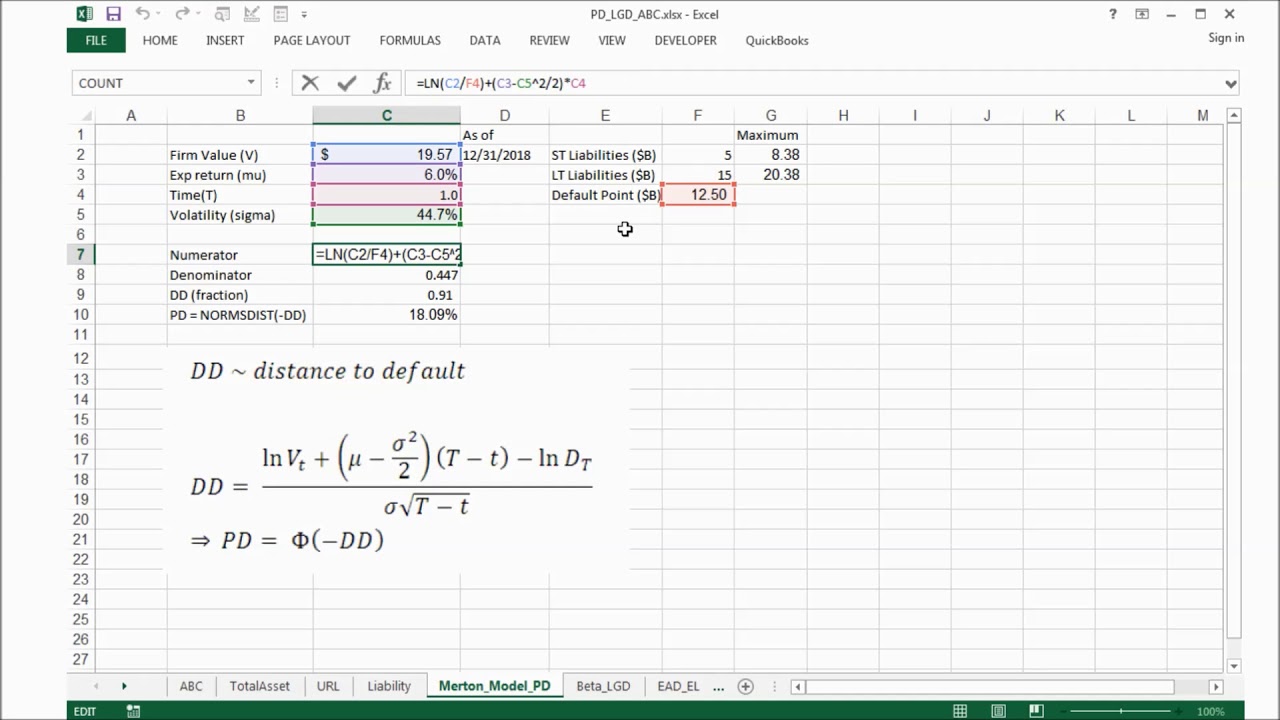

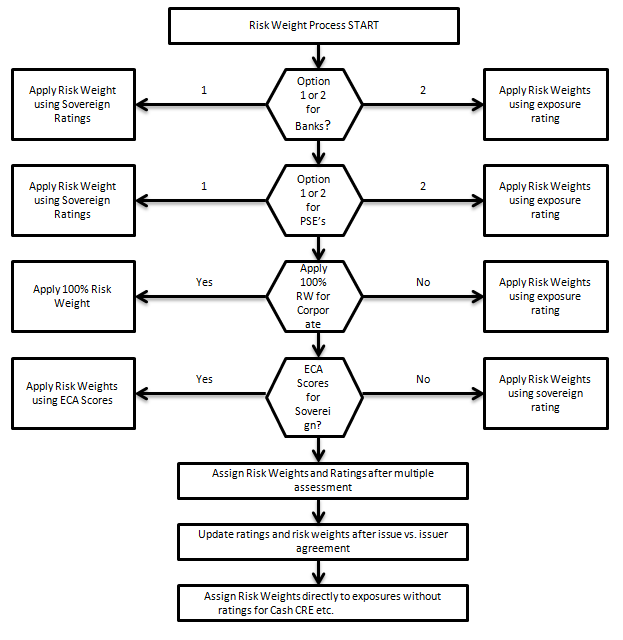

Manoogian Risk Management Consultants - BASEL II IRB APPROACHE: AN OVERVIEW The internal-rating based (IRB) approaches are more sophisticated than the standardized approach, and they require more work and attention. However, on

Basel IV Calculating Ead According To The New Standardizes Approach For Counterparty Credit Risk Sa CCR | PDF | Derivative (Finance) | Margin (Finance)